massachusetts estate tax rates table

Take the Assessed Value of the property then multiply it by the Property Tax Rate and then divide it by 1000. Discover Helpful Information and Resources on Taxes From AARP.

Oecd Tax Revenue Sources Of Revenue In The Oecd 2022

The estate tax rate for Massachusetts is graduated.

. The federal estate tax exemption is at a historic high in 2019 of 114 million for individuals 228m for couples. December 31 2000 see Massachusetts Estate Tax Return Form M-706. The estate tax is a transfer tax on the value of the decedents TAXABLE estate before distribution to any beneficiary.

Future changes to the federal estate tax law have no impact on the Massachusetts estate tax. 22 rows The income rate is 500 and then the sales tax rate is 625. For example if a home in Cambridge is assessed at 1000000.

An estate valued at 1 million will pay about 36500. Massachusetts has an estate tax on estates over 1 million. For estates of decedents dying in 2006 or after the applicable exclusion amount is 1000000.

Massachusetts Estate Tax Rate. Additionally because the taxable estate of 5000000 exceeds 1000000 the estate tax due is 391600. The Massachusetts estate tax uses a graduated rate ranging from 08 to 16 percent.

If you were to translate the amount owed into a tax rate on the portion of the estate that exceeds the Massachusetts exemption amount of 1 million the top rate would be 16that is you would not be taxed more than 16. Your 2021 Tax Bracket to See Whats Been Adjusted. A properly crafted estate plan may.

The credit on 400000 is 25600 400000 064. Estates with a net value of more than this pay an estate tax as high as 16. This means if your estate is worth 15 million the tax applies to all 15 million not just the 500000 above the exemption.

Compare these rates to the current federal rate of 40 Deadlines for Filing the Massachusetts Estate Tax Return. From Fisher Investments 40 years managing money and helping thousands of families. The formula to calculate Massachusetts Property Taxes is Assessed Value x Property Tax Rate1000 Massachusetts Property Tax.

Massachusetts estate tax returns are required if the gross estate plus adjusted taxable gifts computed using the Internal Revenue Code in effect. A Massachusetts estate tax return Form M-706 is required to be filed because the decedents estate exceeds the filing threshold. Estate tax rates range from 08 to 16.

Poor planning can tip the estate over that threshold and result in a huge tax bill. 5000000 - 60000 4940000. This is why residents whose estates hover around the 1 million mark have to be especially careful.

Ad Take out the guesswork with The Investors Guide to Estate Planning for 500k portfolios. Map of 2022 Massachusetts Property Tax Rates - Compare lowest and highest MA property taxes. 402800 55200 5500000-504000046000012 Tax of 458000 Thoughtful estate planning is very important especially for those that wish to leave assets to their beneficiaries or heirs without being impacted by significant taxes.

Ad Compare Your 2022 Tax Bracket vs. US Estate Tax Return Form 706 Rev. If youre responsible for the estate of someone who died you may need to file an estate tax return.

The rate ranges from 8 to 16. Unless specifically stated this calculator does not estimate separate estate or inheritance taxes which are levied in many states. The 2019 Massachusetts estate tax exemption is 1 million.

A guide to estate taxes Mass Department of Revenue The adjusted taxable estate used in determining the allowable credit for state death taxes in the table is the federal taxable estate total federal gross estate minus allowable federal deductions less 60000. An estate valued at exactly 1 million will be taxed on 960000. The maximum credit for state death taxes is 64400 38800 plus 25600.

The Massachusetts Estate Tax applies to individuals with assets worth over 1 Million and the tax rate varies. In this example 400000 is in excess of 1040000 1440000 less 1040000. The Massachusetts estate tax is calculated by.

22 rows Massachusetts Estate Tax Rates. When the second of two spouses dies the exemption is still only 1 million. The Massachusetts estate tax is equal to the amount of the maximum credit for state death taxes.

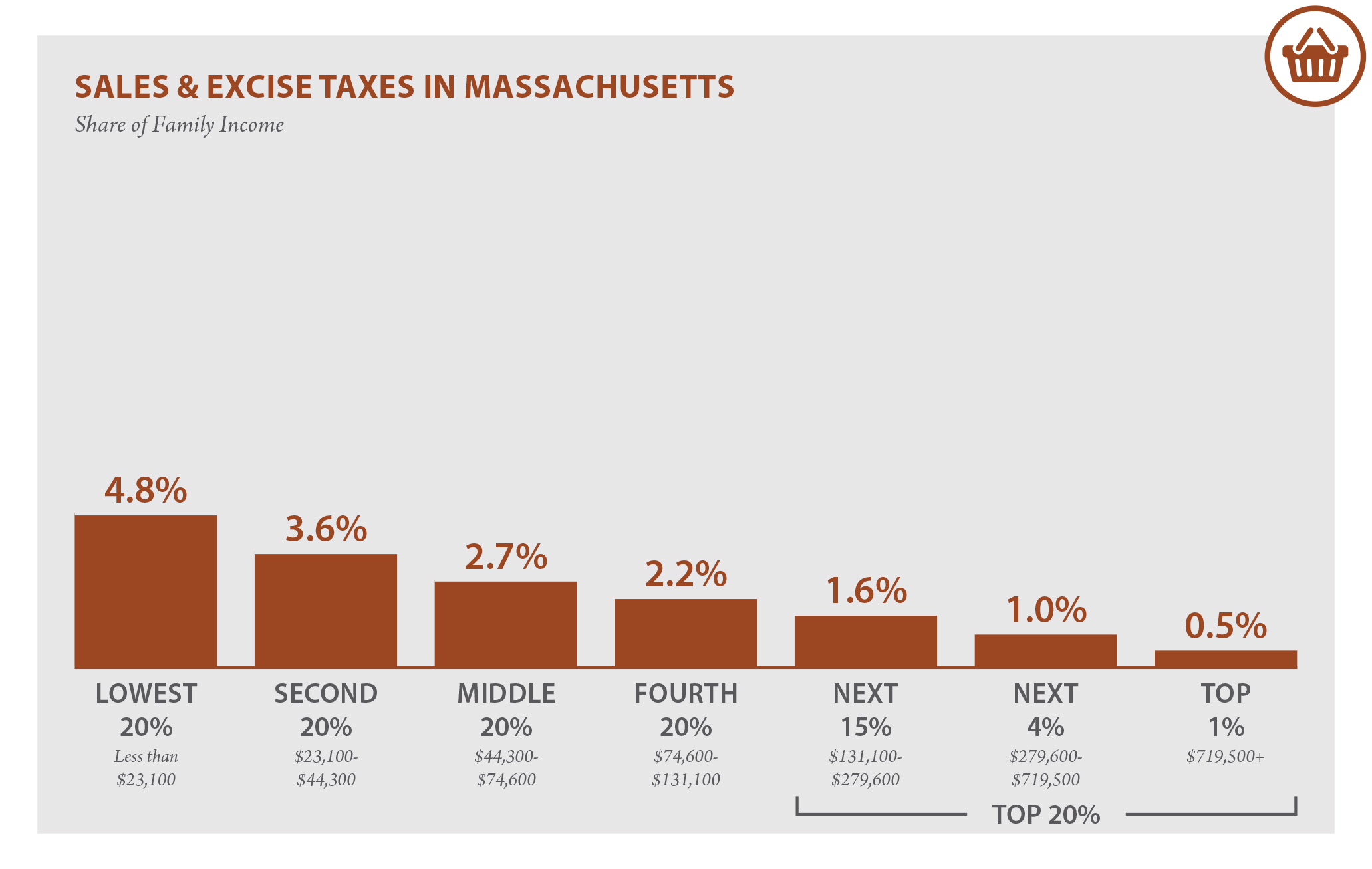

Sales rate is in the top-20. Massachusetts estate taxes. Up to 100 - annual filing.

This tool is provided to help estimate potential estate taxes and should not be relied upon without the assistance of a qualified estate tax professional. Example - 5500000 Taxable Estate - Tax Calc. 18 rows Tax year 2022 Withholding.

However for most individuals who have assets between 1M and 5M then the tax rate hovers anywhere from 0 to 20. If the estate is worth less than 1000000 you dont need to file a return or pay an estate tax. The exemption is not portable between spouses.

Massachusetts Estate Tax Rates Highlighted Section. Cambridge has a property tax rate of 592. All printable Massachusetts tax forms are in PDF.

The Massachusetts estate tax for a resident decedent generally is the Credit for State Death Taxes number shown on Line 15 of the July 1999 Form 706 see Form M-706 Part 1. If a person is subject to both the Federal and State tax then their marginal estate tax rate could be 45 or more. Using the table this tax is calculated as follows.

Your estate will only attract the 0 tax rate if its valued at 40000 and below. Massachusetts uses a graduated tax rate which ranges between 08 and a maximum of 16.

How Do State And Local Corporate Income Taxes Work Tax Policy Center

A Guide To Estate Taxes Mass Gov

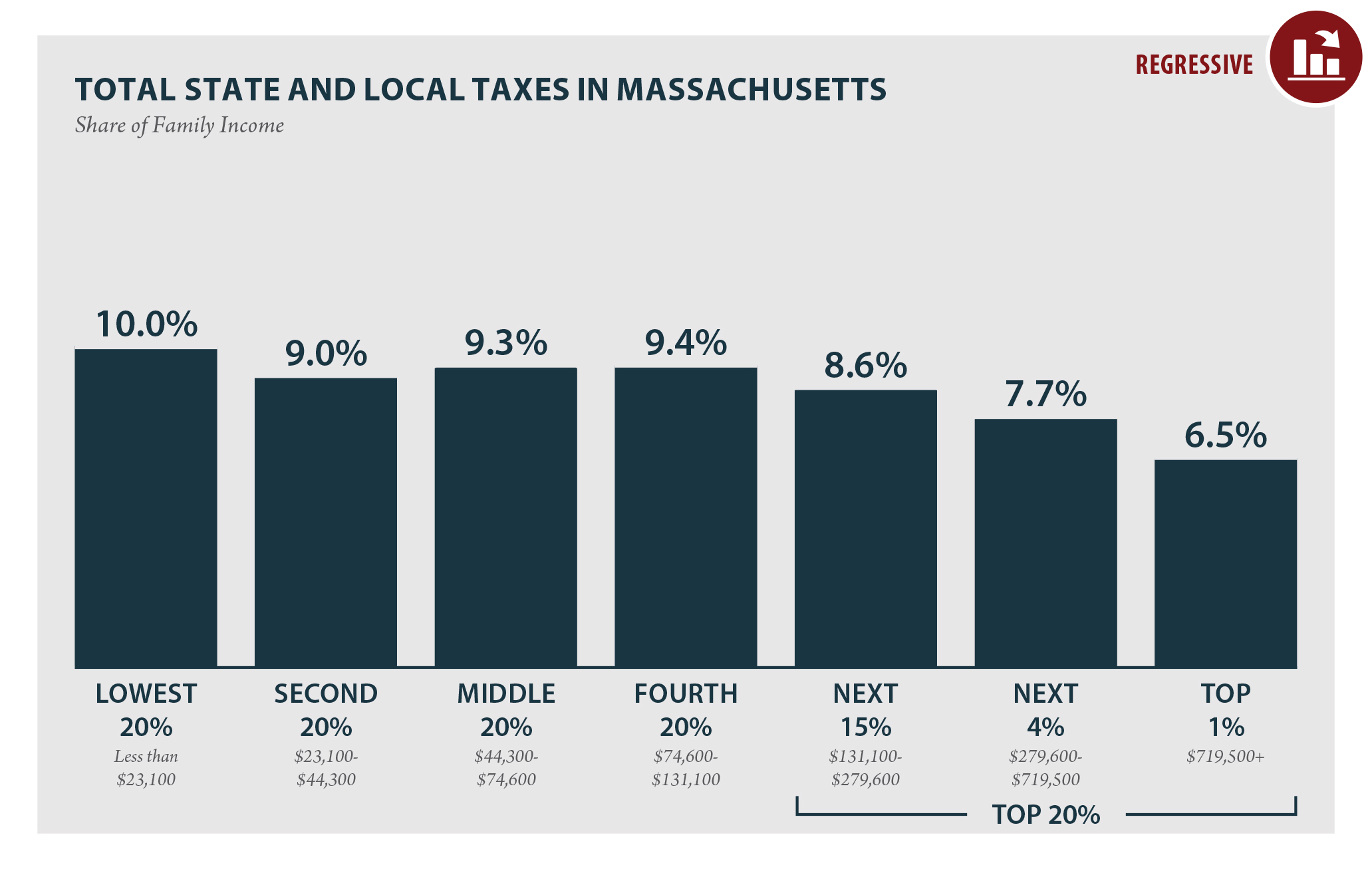

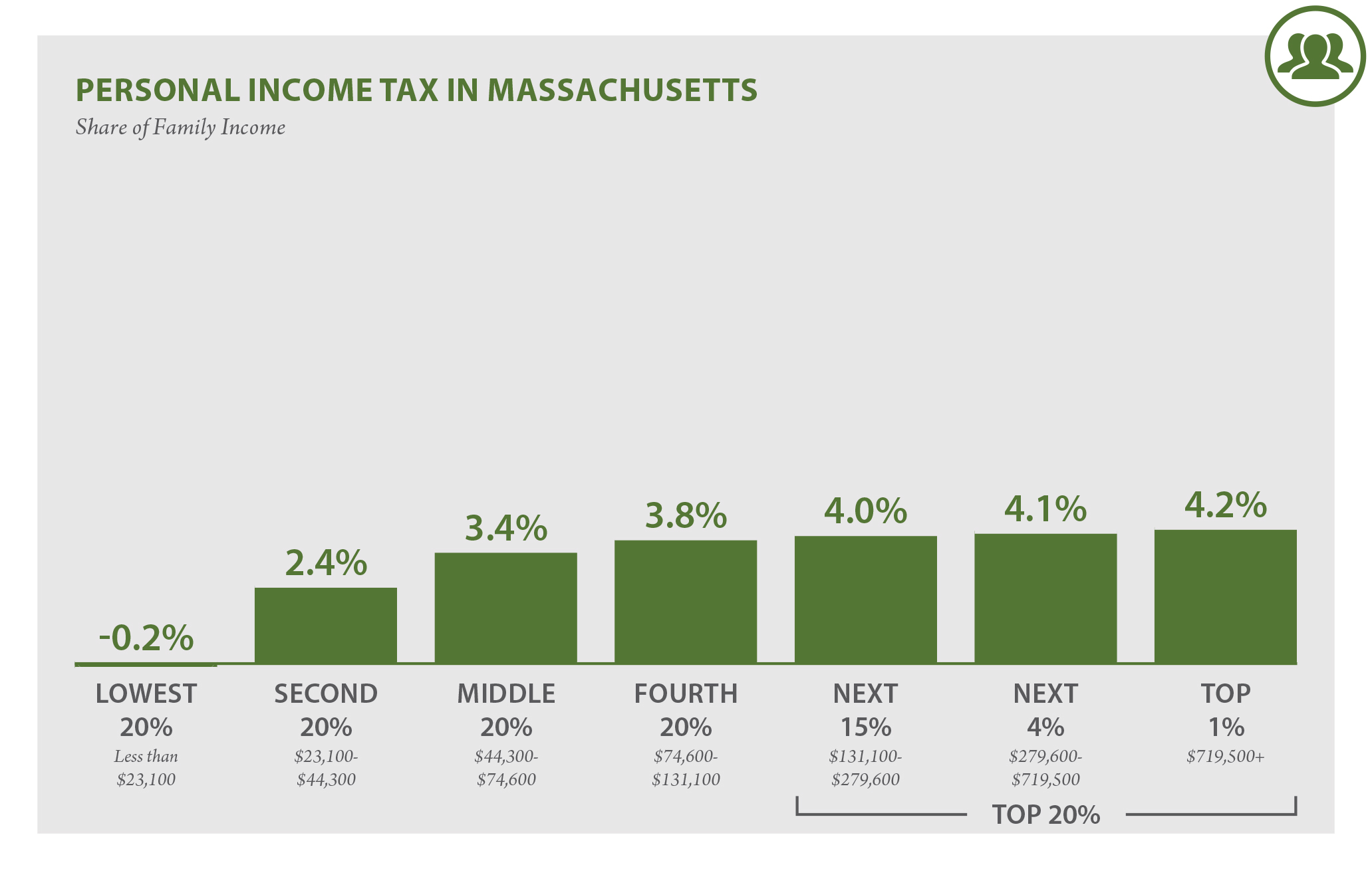

Massachusetts Who Pays 6th Edition Itep

How Is Tax Liability Calculated Common Tax Questions Answered

2022 Tax Inflation Adjustments Released By Irs

State Corporate Income Tax Rates And Brackets For 2022 Tax Foundation

How Do State Estate And Inheritance Taxes Work Tax Policy Center

States With Highest And Lowest Sales Tax Rates

Massachusetts Estate Tax Everything You Need To Know Smartasset

Massachusetts Estate Tax Everything You Need To Know Smartasset

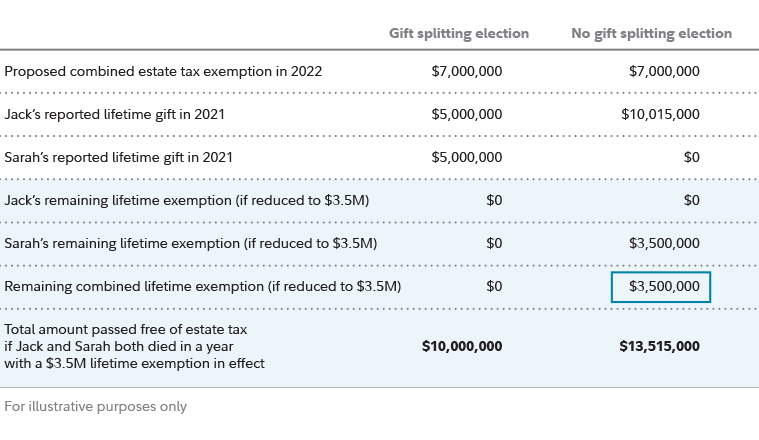

Massachusetts Estate And Gift Taxes Explained Wealth Management

Estate Planning Strategies For Gift Splitting Fidelity

How Do State And Local Corporate Income Taxes Work Tax Policy Center

Massachusetts Who Pays 6th Edition Itep

How Is Tax Liability Calculated Common Tax Questions Answered

Massachusetts Who Pays 6th Edition Itep

Massachusetts Estate Tax Everything You Need To Know Smartasset

2022 Sales Taxes State And Local Sales Tax Rates Tax Foundation